BLOG | BY CO-FOUNDER & HEAD OF INTERNATIONAL BUSINESS ALEX IACOPONI

Why Private Equities are investing in sport, where they see the value, and why clubs and leagues need financial intelligence and data.

The German Football League (DFL) is going to invite investment bids for a minority stake in its overseas media rights business, according to Bloomberg.

Japanese financial services company Nomura were reportedly hired to handle the tender and Bloomberg reports that as many as 30 bidders could enter the race, with Bain Capital, CVC Capital Partners, General Atlantic, KKR & Co, Advent International and BC Partners having previously been cited as interested parties. CVC Capital already own a 27% stake in Premiership Rugby, the English rugby union top flight.

A private equity consortium led by CVC Capital Partners and Advent is now close to acquiring 10% stake in Serie A’s new media business for €1.7 billion and in recent weeks BC partners are eyeing an important investment in Inter Milan.

In a recent interview with Bloomberg, Nikos Stathopoulos, top manager of BC Partners stated:

“Inter? Obviously I can’t comment on deals that have not taken place but we are certainly considering investing in the sports industry, be it league or club-owned. And the club should be a club with a high chance of competing at the highest level ”.

Stathopoulos is partner, chairman of the portfolio management committee, member of the executive committee, as well as guiding the company’s investments in telecommunications and media with particular attention to the investments in Italy of the BC Partners fund, in negotiations with Suning to buy the Inter.

“We are approaching the world of sport from a content point of view. Sport is a great source of high-value content – it’s real-time, it’s unique, and such content has value. Like music and cinema, sport has very attractive content for the public, ”continued Stathopoulos.

“Sport has content that can be monetized. It is less important whether it is a league or a club, it obviously depends on what is available on the market. Sport is an industry we are looking at more and more and it is a growing industry. The monetization of content is a trend that we will see more and more, sport is not a sector with rules like all other industrial sectors and private equity funds can be catalysts in institutionalizing a sector that is very attractive and growing “.

“How does the growth of Amazon and Netflix change the choices in sports investments? It’s a great example of the type of asset that is growing these days and the type of content to invest in because it can grow to maximize value.

The growth of Netflix etc has institutionalized the sector and shows that content can have great value, just look at the value of Netflix today which is not comparable with the value of any club in any sport ”.

“I don’t think there are major differences in having private equity fund ownership fully or partially, as many of the negotiations with the leagues involve minority stakes.

The funds would bring capital and potentially even more professionalism, more discipline and more rules to leagues and clubs that are now driven from a more individual point of view. I don’t think there should be any concern for the entry of those who have brought more discipline and rules to the sectors where they have previously invested.

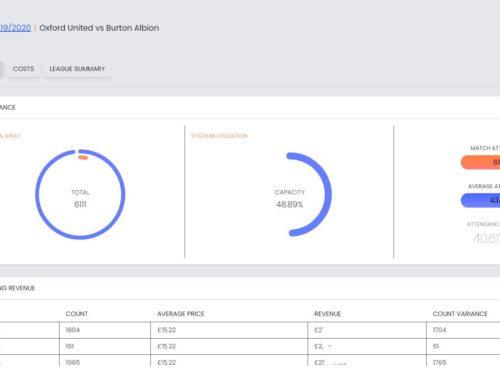

Leagues and clubs of all sizes can now embrace data science and financial intelligence to attract private equity investment and institutional investors.

A lot of clubs can be supported by leagues to become more data driven in their decision making and ClubView is looking to partner with innovative leagues to manage their post-covid recovery where there are a lot of opportunities to grow and maximise value of their assets.

We can be a catalyst to support leagues of all sizes with a bespoke approach towards financial sustainability so the pyramid can be better protected,, harnessing the power of data and being able to extract useful information in real-time.